The death of Demand

So I've been having discusions w/ co-workers and they are more in the "soft-landing" camp than am I. Actually, it took quite a bit of convincing to get them that far and honestly I don't think it was me that swayed them. I've been going on about the bubble ending for 6 months and they've only come around in the last month since all the MSM coverage finally began.

Their idea behind a "no-bust" or "soft-landing" scenario is basically that sales are down now but there are a lot of buyers on the sidelines and once prices go down a bit, say 10%, demand will jump back up.

I think that's an intuitive response, given your basic econ 101 supply and demand, but dead wrong in this case. Here's why: consider demand. The demand we've seen over the past few years was vastly inflated. And it's been inflated in almost every conceivable way:

1. Speculative demand accounted for 38% of sales in 2004 and 2005. This is, of course, due to the incredible rate of appreciation, and the massive amount of money that could be made in a short time through leveraging (borrowing more to make more). Of course there was high demand for a 20% appreciating asset! That's why there were bidding wars and "please pick me" letters and why houses would sell in one weekend above the asking price. In fact to say speculation was only 38% would be foolish because even people buying as a "primary residence" knew that the market was so hot, they would be making more money (in their sleep) off of their house (read: investment) than with their 9-5! "You couldn't lose"! This level of speculation, where the appreciation itself is fueling the appreciation, was seen last during the .com boom/bust. We won't see it again in housing for a long, long time. And worthwhile to note that all of this speculative demand has now shifted to the supply side.

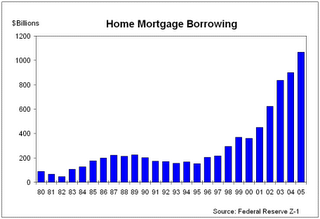

2. Cheap money. All-time low interest rates made monthly payments low enough that buying a house came into reach for a lot of people even as home prices shot up, while a more historically "normal" interest rate wouldn't have allowed that. A good portion of these buyers would have represented "future demand" had they not been used up. After 17 sucessive interest rate hikes, do you think the FED is going to slash rates to 1% again?

3. Toxic loans - ARM's / interest-only / neg-am loans raised the "ceiling of affordability" for buyers. These loans can work to a buyers advantage in an appreciating market, but in a depreciating market things get ugly quickly. As stated earlier, a lot of people speculated that prices would continue to rise, accepting the risk of these loans. Other "less sophisticated" buyers were tricked into thinking they could afford these loans by predatory lenders and realtors. This is scraping Demand's "bottom of the barrel". In either case, the ceiling of affordability simply can't be raised any higher without loosening lending standards, coming up with new "creative loans", or lowering interest rates. And that's not too likely at this point is it?

4. Lenders allowed lending standards to become so lax that anyone with a pulse could get a half million dollar loan - whether they could afford it or not. Stated-income / "no-doc" loans, or "liar-loans" allowed people who could not afford homes to buy them anyway. How does a 21 yr old kid get $2.2 million in loans? By EVERYONE looking the other way. The amount of fraud and collusion is unbelievable. The Senate had inquiries last week over this and in the VERY FIRST bit of good news, "State targeting abusive lenders", Massachusetts is going after predatory lenders.

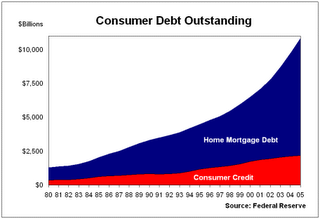

5. Homeownership is now at an all-time high already thanks to #2-4 above - 3% above the historical average - at least for now until the foreclosures really begin to kick in, at which point lives (and credit) will be ruined, life savings lost, comps forced down, and foreclosed properties added to Supply. BTW, foreclosures are already up 250% in San Diego and the ARM reset's have hardly started! And guess who pays for the bad paper when the loan goes into default? All of us! If you have investments there's a very good chance you have MSB's (mortgage backed securities) and that your MBS's will de-value when the loans start defaulting en masse.

6. Affordability. Last time I heard, in San Diego, affordability was at 2%. This means only 2% of the population can afford to buy a median priced home. Housing is like a pyramid in that it starts w/ first time buyers. If someone wants to move up to a larger home (family is growing), they need to sell their 1st home. People will typically go from "starter homes" to bigger & more expensive homes throughout their lives, as opposed to downsizing. So if first-time buyers are "locked out" because of affordability, we're now in a gridlock situation. In essence, it's impossible to be "priced out forever" because the market NEEDS first-time buyers to sustain itself, and will adjust accordingly. "Priced out forever" is a realtor scare tactic.

7. Psychology - Just as appreciation fuels appreciation, the same is true for depreciation. "Buy before you're priced out forever" - that was the psychology (and Realtor cliche). That's now changed to "buy a depreciating home now and be screwed good when the price drops another 10%."

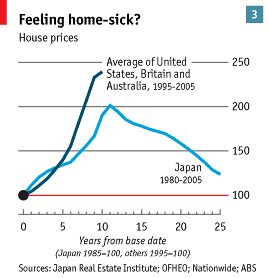

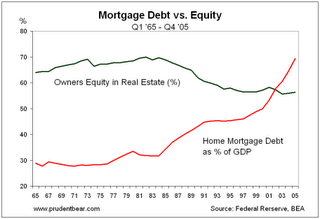

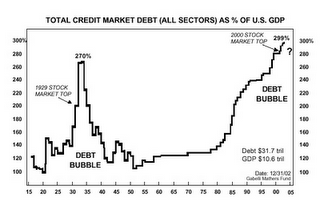

The "ceiling of affordabilty" has been pushed up and up through a credit expansion driven by incredibly low interest rates, "creative lending", collusion and fraud. This, coupled with speculation created a huge amount of demand - artificial, inflated demand. This demand help to sustain the bubble, fueling it to unprecendented levels. But there's nowhere left to go. While median home values jumped 32 percent from 2000 to 2005 nationwide (and more like 200-300% in bubble areas), incomes dropped 2.8 percent during the same period.

If the hangover from credit expansion and debt bomb result in reduced consumer spending and layoffs, a recession would further reduce demand.

Affordability is now at an all-time low. Even if prices come down a bit, affordabilty may not improve if rates go higher. Who else is left to buy that hasn't? Recent graduates and illegal immigrants? Not at these prices. There are some bubble-watchers, myself included, and a certain amount of people who may be at a point in their lives when they're just ready to buy. Let's acknowlege that there will always be some demand but not overestimate overall Demand without scrutiny. My two co-workers think of Demand as a single-sized, consistent force that's either up or down. I think that's a very naive viewpoint. It's anything but. And there's just not that much real Demand left.