Denial in the face of decline

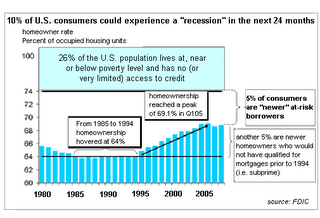

Went to a couple of open houses in South Bay this weekend. I didn't sense a lot desperation, but the realtors were certainly not in stand-off mode that they were a year or two ago. They were much more engaging. I even got a "now is a good time to buy." Yeah ... right. Talk about rolling the dice. Anyone buying now, unless you're getting 20-30 under asking price is going into negative equity IMO. If you're going to live there forever, no problem, but if you think you might want to move in 5-10, you should rent an equivalent place for half price, because you'll be lucky to get what you paid for it. If you have to sell any sooner, you'll be in deep, deep debt for a long time.

Home prices drop dramatically - Nationally, the median price of a new home plunged in September by the largest amount in more than 35 years, down nearly 10 percent from September 2005.

Housing Decline Slows the Economy - The bursting housing bubble slowed economic growth in the third quarter to 1.6 percent, its slowest rate of expansion since the first quarter of 2003, according to a preliminary estimate by the Commerce Department. Economists were expecting growth of around 2.1 percent, down from 2.6 percent in the second quarter. There's no doubt that another huge drop-off in residential real-estate investment was again a prime culprit in the economy's sharp slowdown.

meanwhile

GAO chief warns economic disaster looms

"Housing is in a full-blown recession" - Merrill Lynch economist David Rosenberg. Link

The principal culprit: housing construction, which plunged at a 17.4-per-cent annual rate, the worst performance since the recession of 1991.

Worse, new-home buyers can now expect that the value of their investment will fall. In the U.S., the national average price of existing single-family homes dropped by 2.5 per cent over the past year, the worst showing since this data began to be compiled in 1969.